No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Harness Cutting-Edge AI for Comprehensive Risk Prevention:

Real-Time Solutions That Set New Standards for Speed and Scalability in Fraud, AML, and Money Mule Detection.

* Gartner, Market Guide for Fraud Detection in Banking Payments, 11 December 2024. GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved. Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Protect your institution from money mule fraud. Lynx’s AI-powered solution identifies illicit funds and mule accounts in real-time, mitigating mules, blocking APPF incoming, and preventing financial losses. Our Daily Adaptive Models ensure accuracy and compliance.

Real-Time Problems Require Real-Time Solutions

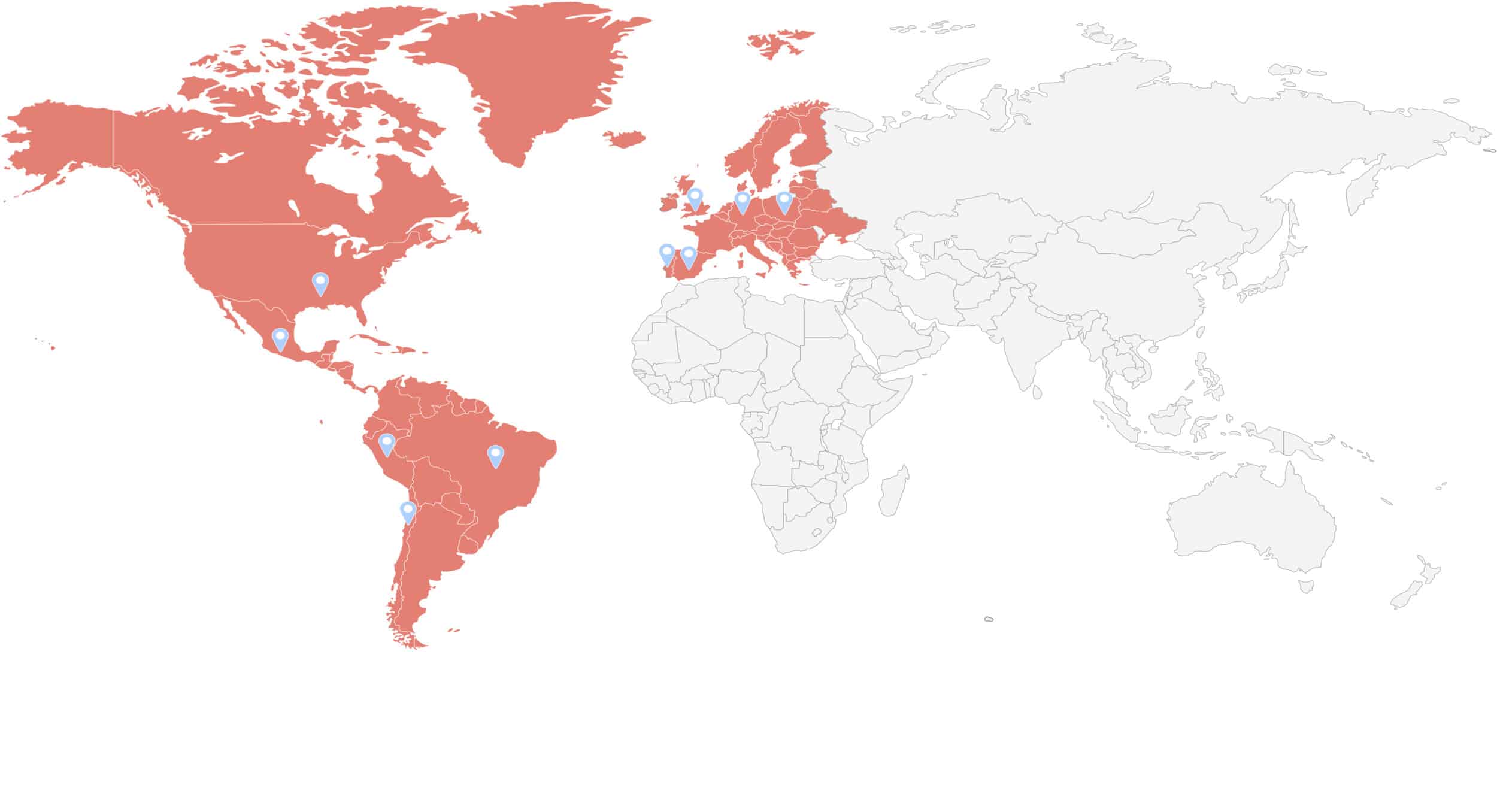

Lynx is trusted by multinational organizations across a global footprint. We illuminate and protect against fraud and financial crime with unmatched speed and expertise.

Thought leadership, latest articles, solutions guides, and news.

Lynx recognised in the 2024 Gartner® Market Guide for Fraud Detection in Banking Payments

Daily Adaptive Model

Navigating Sanctions in a Faster Payments World: 4 Key AML Insights

4 Ways Financial Institutions Can Stop Money Mules in Their Tracks

Fraud Prevention

Romance scams: A hidden danger in the digital dating world

Let us assist you in the fight against fraud and financial crime.